In the recent years, there has been a steep rise in the prices of goods and services. While most young Indian households are opting for dual-income avenues to make ends meet, investment is the sole vehicle that helps them create a financially secure future too. With inflation devaluing our currency with every passing year, we usually find ourselves lacking funds to manage our current and future costs. Investing helps us create additional income and/or generate wealth in the long term.

Where do Indians invest?

India has been a land of rich culture and tradition. We have always been a family-centric society and try to keep ourselves prepared for the financial costs associated with our lives and the lives of our family members.

Around 100 years ago, if someone wanted to invest, then he/she would either purchase land or gold. However, these investments needed to be safeguarded which in turn increased costs. Eventually, as the banking services evolved, deposits and government-run saving plans soon replaced gold/land investments. The equity and mutual fund investments were the next to offer investors targeted returns based on their financial goals.

In the last decade, many investors parked their hard earned money in certain stocks or mutual funds. But, there was always an element of market risk associated with their investment which could not be ignored.

Peer to Peer Lending

The last decade also saw the evolution of digitization in India. An internet access in every household, platform models replacing the traditional pipeline models of business, and democratization of services soon gave birth to the sharing economy. The investment market also received its fair share of democratic innovations. Fintechs, or financial services offered as an end-to-end process over the internet, came up with various avenues to replace the original ownership model of traditional financial services.

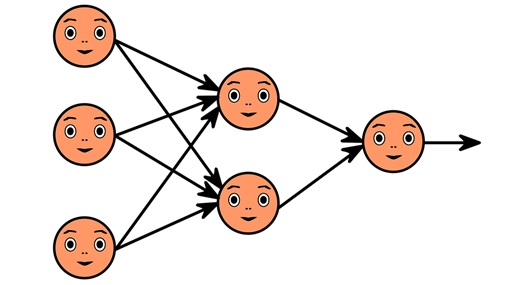

Soon, entrepreneurs started analyzing various financial services and working out cost and time efficient ways of offering those services. The lending-borrowing process was largely owned by banks and a few financial institutions. Fintechs realized that if investors could lend funds to borrowers directly, without the intervention of any bank, then it could benefit both, the investors and the borrowers. This led to the birth of peer-to-peer (P2P) lending platforms.

Most Indians are known to be conservative in their investment methods. Peer to Peer lending, as a concept, has been prevalent in our society for ages. For example, what do you do when you need some urgent funds? Most of us don’t talk about a loan upfront, do we? We turn to our family, friends, well-wishers, etc. P2P lending platforms allow people to borrow funds from a peer network at rates proportional to their credit profile. Investors get a chance to earn up to 30% returns without exposing their capital to market risks.

Here are some benefits offered by peer to peer loans to investors:

1. Returns: You can earn up to 30% returns on your investments.

2. No Lock-ins

3. Market volatility: P2P lending investing is not dependent on the movement of the market (except events that have a macro-level impact on our nation). Therefore, these investments are less volatile as compared to their market-linked counterparts.

4. Easy tracking: By diversifying your investments across different risk classes and multiple borrowers within every risk class, you get the benefit of an investment portfolio which has a balance between high and low-risk investments along with single point tracking.

5. Fees/ charges: Most P2P platforms allow you to become an investor and lend funds to borrowers at minimal charges. The charges usually include a one-time registration charge, disbursal, and cancellation fee. There are no hidden charges.

Why Indians should invest in peer-to-peer lending?

India is growing. However, the growth of an economy also brings with it some ups and downs. These ups-n-downs can cause the markets to be more volatile. With peer-to-peer lending, you are in control of the risks associated with your investment (the risk of default). Market volatility does not affect the performance of your investment portfolio and a well-diversified P2P lending portfolio can bring down the risk of default to a great extent too. You can choose borrowers based on their risk classification and your financial goals and risk preference.

People Lend, a leading name in Peer to peer lending, understands that as Indians, we have a knack for saving money. However, many of us do not have the time or expertise to research and analyze the markets well before investing. People Lend ensures that both investors and borrowers are thoroughly scanned before allowing access to the portal. All you have to do is register as an investor, fill up an online application form, submit scanned copies of the documents and start offering loans to pre-verified borrowers.